All Categories

Featured

Table of Contents

On the other hand, if a client needs to provide for a special needs kid who may not have the ability to handle their very own money, a count on can be added as a recipient, enabling the trustee to manage the circulations. The kind of recipient an annuity owner picks affects what the recipient can do with their acquired annuity and exactly how the proceeds will certainly be strained.

Several agreements allow a partner to determine what to do with the annuity after the proprietor dies. A spouse can transform the annuity agreement into their name, presuming all rules and civil liberties to the preliminary agreement and delaying immediate tax obligation repercussions (Income protection annuities). They can accumulate all continuing to be payments and any survivor benefit and select beneficiaries

When a spouse becomes the annuitant, the spouse takes over the stream of settlements. This is called a spousal extension. This clause permits the surviving partner to maintain a tax-deferred condition and safe lasting monetary security. Joint and survivor annuities likewise enable a called beneficiary to take control of the contract in a stream of repayments, as opposed to a round figure.

A non-spouse can only access the designated funds from the annuity owner's first contract. Annuity proprietors can select to mark a depend on as their beneficiary.

Is there a budget-friendly Senior Annuities option?

These distinctions mark which recipient will certainly receive the entire survivor benefit. If the annuity owner or annuitant dies and the key recipient is still active, the primary beneficiary gets the survivor benefit. Nevertheless, if the key beneficiary predeceases the annuity proprietor or annuitant, the death advantage will most likely to the contingent annuitant when the owner or annuitant passes away.

The proprietor can alter beneficiaries at any time, as long as the agreement does not call for an irreversible beneficiary to be named. According to experienced contributor, Aamir M. Chalisa, "it is essential to understand the value of designating a recipient, as choosing the wrong beneficiary can have severe effects. A lot of our customers choose to call their underage kids as recipients, often as the key beneficiaries in the absence of a partner.

Proprietors that are married should not presume their annuity automatically passes to their partner. When picking a recipient, think about elements such as your partnership with the individual, their age and just how acquiring your annuity may affect their financial situation.

The beneficiary's connection to the annuitant generally identifies the guidelines they comply with. As an example, a spousal recipient has even more options for managing an inherited annuity and is treated even more leniently with tax than a non-spouse recipient, such as a kid or other member of the family. Long-term care annuities. Expect the owner does choose to call a youngster or grandchild as a beneficiary to their annuity

Who provides the most reliable Retirement Income From Annuities options?

In estate preparation, a per stirpes designation specifies that, ought to your beneficiary pass away prior to you do, the recipient's offspring (kids, grandchildren, and so on) will certainly receive the survivor benefit. Attach with an annuity specialist. After you have actually selected and called your recipient or beneficiaries, you must proceed to examine your options at the very least when a year.

Maintaining your designations up to day can make sure that your annuity will certainly be managed according to your wishes should you pass away suddenly. Besides an annual review, major life events can prompt annuity proprietors to take one more appearance at their beneficiary selections. "Somebody might intend to update the beneficiary classification on their annuity if their life scenarios alter, such as getting married or divorced, having kids, or experiencing a fatality in the family," Mark Stewart, CPA at Step By Action Organization, told To transform your beneficiary designation, you should connect to the broker or representative that handles your agreement or the annuity service provider itself.

Are Tax-efficient Annuities a safe investment?

As with any kind of economic item, looking for the help of a monetary expert can be beneficial. A monetary coordinator can guide you via annuity management processes, consisting of the methods for updating your agreement's recipient. If no recipient is named, the payout of an annuity's fatality advantage goes to the estate of the annuity holder.

To make Wealthtender complimentary for readers, we gain cash from marketers, consisting of economic experts and companies that pay to be included. This develops a dispute of interest when we favor their promotion over others. Review our content plan and regards to solution to read more. Wealthtender is not a customer of these monetary providers.

As an author, it's one of the very best praises you can provide me. And though I actually value any of you investing a few of your hectic days reviewing what I create, clapping for my write-up, and/or leaving appreciation in a remark, asking me to cover a topic for you truly makes my day.

It's you saying you trust me to cover a subject that is necessary for you, which you're certain I 'd do so better than what you can currently find online. Pretty spirituous stuff, and a duty I do not take likely. If I'm not acquainted with the topic, I investigate it on-line and/or with calls who recognize even more regarding it than I do.

Annuities For Retirement Planning

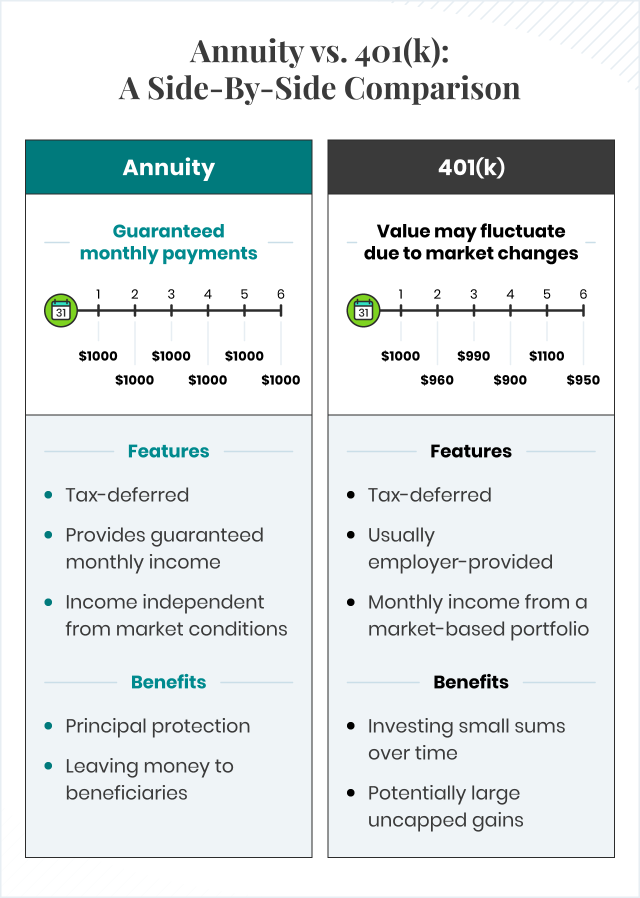

In my friend's instance, she was assuming it would certainly be an insurance coverage of sorts if she ever enters into nursing home treatment. Can you cover annuities in a post?" So, are annuities a valid suggestion, an intelligent transfer to secure guaranteed income permanently? Or are they a dishonest advisor's means of fleecing unsuspecting customers by persuading them to move possessions from their profile right into a complicated insurance policy item plagued by too much fees? In the easiest terms, an annuity is an insurance policy product (that only qualified agents may sell) that ensures you monthly settlements.

How high is the surrender fee, and how much time does it use? This usually relates to variable annuities. The even more cyclists you tack on, and the much less risk you agree to take, the reduced the repayments you need to anticipate to obtain for a provided costs. The insurance provider isn't doing this to take a loss (however, a bit like a gambling establishment, they're prepared to shed on some clients, as long as they more than make up for it in higher earnings on others).

Annuities For Retirement Planning

Annuities selected correctly are the appropriate selection for some people in some situations., and then number out if any annuity option uses sufficient benefits to validate the prices. I used the calculator on 5/26/2022 to see what an immediate annuity may payment for a single premium of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Comprehensive Guide to Fixed Interest Annuity Vs Variable Investment Annuity What Is Retirement Income Fixed Vs Variable Annuity? Features of Choosing Between F

Understanding Financial Strategies Key Insights on Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Fixed Vs Variable Annuity Features of Deferred Annuity Vs Variable Annuity Wh

Decoding Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Indexed Annuity Vs Fixed Annuity What Is the Best Retirement Option? Benefits of Indexed Annuity Vs Fixed Annuity Why

More

Latest Posts